Founded by data scientists and AI researchers, HR Signal™ uses predictive people analytics to help companies improve employee retention and talent development.

All data in this report is from HR Signal’s Workforce Insights Engine™

January 2022 to June 2023: Greater Cleveland Talent Insights Report

HR Signal is a trailblazer in AI-powered People Analytics, providing a platform to dramatically improve employee retention and talent development.

HR Signal’s proprietary Workforce Insights Engine contains billions of data points spanning career, market and public data. This report is a focus on the Greater Cleveland area to generate insights into regional talent trends across industries and employers.

Foundations and Framework

Report Objectives

This report aims to provide a comprehensive analysis of the so-called “white collar” workforce trends and insights in the Greater Cleveland Metro Area over an 18 month period. It is designed to be a valuable resource for local business leaders, human resource teams, and the media.

Overview of the Greater Cleveland Metro area workforce

The Greater Cleveland Metro Area is a vibrant economic hub, with a diverse population of over 2 million people. This report was generated by analyzing the majority of people within Greater Cleveland’s “white collar” workforce.

How was this report generated?

HR Signal’s Workforce Insights Engine™ is a large scale analysis system that leverages machine learning and AI to process a vast amount of workforce data. The goal is to generate an understanding and forecast of companies, people, industries and regions.

Data Sources

This report’s data comes from publicly available resumes and career profiles.

Scope of the Report

This report focuses on the “white collar” workforce in the Greater Cleveland Metro Area, comparing changes over an 18 month period from January 2022 to June 2023.

Methodology

The report employs quantitative analysis using data representing the majority. Data was processed and analyzed to derive insights into turnover, internal mobility, and positions.

Select Definitions

- Turnover – the aggregate of voluntary and involuntary employee departures from an organization.

- Internal Mobility – the movement of employees within an organization, encompassing promotions, lateral shifts, and demotions.

Turnover: Top 10 Companies

Top 10 Company Turnover Rates

55% – An Energy industry firm

46% – A Legal Services industry firm

41% – A Mortgage Services industry firm

37% – An Automotive industry firm

36% – A Manufacturing industry firm

33% – A Healthcare industry firm

32% – A Technology industry firm

32% – A Real Estate industry firm

31% – An Information Tech & Services industry firm

31% – A Financial Services industry firm

Turnover: By Industry

Top 10 Industry Turnover Rates

35.3% – Energy

30.3% – Mortgage Services

18.5% – Software

18.0% – Pharmaceuticals

17.6% – Marketing & Advertising

17.3% – Electrical Equipment

17.1% – Business Services

17.0% – Information Tech & Services

17.0% – Apparel & Fashion

16.1% – Home Improvement Services

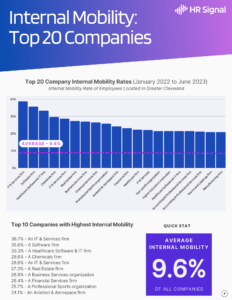

Internal Mobility: Top 20 Companies

Top 10 Companies with Highest Internal Mobility

38.7% – An IT & Services firm

35.6% – A Software firm

33.3% – A Healthcare Software & IT firm

29.6% – A Chemicals firm

28.6% – An IT & Services firm

27.3% – A Real Estate firm

26.9% – A Business Services organization

26.4% – A Financial Services firm

25.7% – A Professional Sports organization

24.1% – An Aviation & Aerospace firm

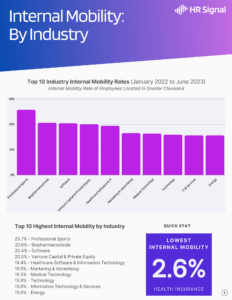

Internal Mobility: By Industry

Top 10 Highest Internal Mobility by Industry

25.7% – Professional Sports

20.6% – Biopharmaceuticals

20.4% – Software

20.0% – Venture Capital & Private Equity

19.4% – Healthcare Software & Information Technology

16.5% – Marketing & Advertising

16.3% – Medical Technology

15.9% – Technology

15.6% – Information Technology & Services

15.6% – Energy

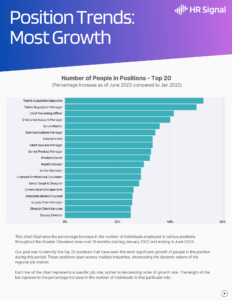

Position Trends: Most Growth

Number of People in Positions – Top 20

This chart illustrates the percentage increase in the number of individuals employed in various positions throughout the Greater Cleveland area over 18 months starting January 2022 and ending in June 2023.

Our goal was to identify the top 20 positions that have seen the most significant growth of people in the position during this period. These positions span across multiple industries, showcasing the dynamic nature of the regional job market.

Each bar of the chart represents a specific job role, sorted in descending order of growth rate. The length of the bar represents the percentage increase in the number of individuals in that particular role.

Position Trends: Most Turnover

Top 10 Highest Turnover by Position

21.4% – Project Coordinator

19.6% – Associate Attorney

18.9% – Senior Account Manager

18.3% – Human Resource Generalist

18.2% – Software Engineer

16.8% – Recruiter

16.5% – Inside Sales Representative

16.0% – Marketing Manager

15.8% – Senior Software Engineer

15.2% – Program Manager

Position Trends: Most Internal Mobility

Top 10 Positions by Internal Mobility

12.3% – Senior Account Manager

10.6% – Senior Financial Analyst

11.4% – Program Manager

10.6% – Senior Accountant

9.9% – Finance Manager

9.6% – Project Engineer

9.3% – Senior Manager

9.2% – Product Manager

8.0% – Associate Attorney

7.4% – Business Analyst

What is HR Signal?

HR Signal™ is a software-as-a-service platform that works with any existing payroll, HRIS or ERP system.

HR Signal:

- Improves employee retention by predicting turnover

- Personalizes each employee’s career path options

- Illuminates workforce trends and forecasts outcomes

- Provides peer benchmarks and real market data

HR Signal’s Workforce Insights Engine™ processes billions of data points across millions of employers, regions and people.

Interested in improving employee retention and talent development at your organization?

Visit www.hrsignal.com

(888) 333 – 6755

[email protected]

hrsignal.com